Today I would like to discuss the importance of critical illness insurance. Is it important for you to take care of your body and continue to have the ability to provide for your loved ones? We all know that life does not always go exactly the way we planned. If you are stricken with a debilitating illness will you have the resources to take care of yourself and your household?

Critical Illness Insurance was developed by Dr. Marius Barnard in South Africa in 1983. Dr. Barnard saw a need for insurance that paid a “living benefit” to those who survived a major illness to offset lost income and pay additional expenses. It is designed to help protect your household from financial hardship and give you the freedom to focus 100% on recovery (not worrying about how you are going to make the next mortgage payment). Critical illness insurance will provide you with a tax-free, lump-sum benefit after satisfying the 30-day waiting period if you’re diagnosed with one of the covered critical illnesses. It’s that simple.

If you develop a critical illness, you may need to take time off work, arrange additional care for your children, travel to specialized treatment centres and more. Help give yourself financial flexibility to do whatever it takes to get better with critical illness insurance.

Critical illness coverage can help you:

- Replace your income

- Manage extra costs:

- Experimental drugs

- Renovate your house(wheelchair accessible)

- New custom vehicle - Advice/treatment from specialty doctor in USA

- Keep up with mortgage and debt payments

- Provide additional income on top of your employee benefits plan

- Keep your business running and minimize disruption

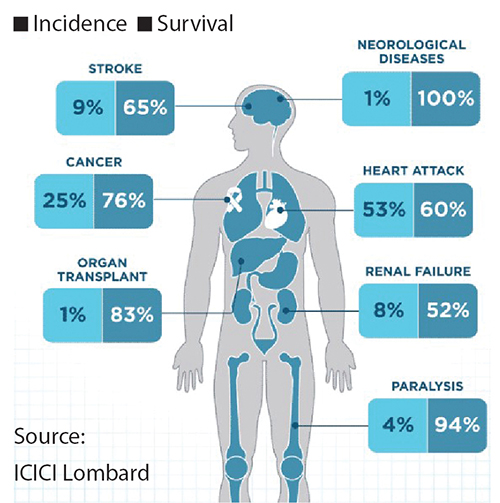

Conditions currently covered in Canada include Alzheimer’s disease, Aortic surgery, Aplastic anaemia, Bacterial meningitis, Benign brain tumour, Blindness, Cancer (life-threatening), Coma, Coronary artery-bypass surgery, Deafness, Heart attack, Heart valve replacement, Kidney failure, Loss of independent existence, Loss of limbs, Loss of speech, Major organ transplant, Major organ failure on waiting list, Motor neuron disease, Multiple sclerosis, Occupational HIV infection, Paralysis, Parkinson’s disease, Severe burns, Stroke (Cerebrovascular accident)

Conditions currently covered in Canada include Alzheimer’s disease, Aortic surgery, Aplastic anaemia, Bacterial meningitis, Benign brain tumour, Blindness, Cancer (life-threatening), Coma, Coronary artery-bypass surgery, Deafness, Heart attack, Heart valve replacement, Kidney failure, Loss of independent existence, Loss of limbs, Loss of speech, Major organ transplant, Major organ failure on waiting list, Motor neuron disease, Multiple sclerosis, Occupational HIV infection, Paralysis, Parkinson’s disease, Severe burns, Stroke (Cerebrovascular accident)

Most people have insurance on their cars, homes, jewelry and holiday trailers and would want full replacement value if destroyed. If you prefer to insure yourself against the loss of these items why would you not insure your health? Sure, you could try to self-insure but why would you if you don’t have to? The cost of coverage is very reasonable compared to the risk. You can even choose a return of premium rider, the insurance company will return all your premiums if you do not make a claim.

Now this might sound a little backwards but, the healthier you are the more you need critical illness coverage. Those already in poor health have a much lower chance of surviving an illness. Those who are healthy have a much higher chance of recovery and that is what this coverage is designed to assist with, your recovery. If you pass away from an illness your life insurance will get paid out but if you experience a failure of health and survive it, your critical illness coverage will allow you to pay the necessary bills. Over the years medical advancements have increased our ability to recover from serious illnesses. This is fantastic because we get to spend more time with our loved ones here on earth and get to enjoy God’s creation for a little longer; but recovery can come at a cost.

If you are concerned about experiencing a failure of health and how that will affect your family and your financial plan please contact me for a chat. I will discuss the pros and cons of each option and design the right plan for you. I look forward to hearing from you.

Blessings,

Ryan Van Nijenhuis, BA

Insurance Advisor

Credential Financial Strategies Inc.

Credential Financial Strategies Inc. offers financial planning, life insurance and investments to members of credit unions and their communities. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal advice. Please speak to your Credential Financial Strategies Representative or personal financial representative before making any financial planning decision or implementing any strategy. Your insurance contract will provide details of the coverage available under the plan you choose. Restrictions may apply.

Search

Search

www.google.com

www.google.com