Are you one of the many concerned about outliving your retirement savings? Thanks to medical advancements we are living longer than our ancestors. Today’s retirees can expect to live approximately 25% longer on average in retirement than their grandparents, to age 87 for men and 88 for women. What’s more, about 20% of us will live to see our 95th birthday or more.

Most of us would like to live a long and healthy life, but that can create some financial challenges. You may find yourself in a situation where you do not have sufficient retirement savings to support your desired lifestyle. What can we do to remedy such a predicament? A well planned annuity strategy can ensure that even if you live to be over 100 you will have sufficient income to cover your retirement expenses.

Annuities may be the best retirement product that we rarely discuss. An annuity is basically a DIY (Do It Yourself) Pension. Not all of us are blessed by having an employer that provides a fully funded defined pension plan. For those of us without a fully funded pension, an annuity may be the perfect fit to cover our fixed expenses in retirement. Annuities are designed to be one part of a larger retirement income plan. Typically it is recommended to annuitize around 25% of your retirement savings; this gives you guaranteed income for life and the flexibility to spend your other money as you wish. If you like the guaranteed income that a pension can provide, then an annuity may be a perfect fit for you. Studies have shown that retirees with pensions and/or annuities are more content.

Many experts say the “sweet spot” for buying annuities is around age 70. One option is to gradually annuitize over three to five years. For example if you plan to annuitize $300,000, you might buy $100,000 of annuities at ages 70, 72 and 74. This timing works great for retirees, since they must convert their RRSPs into either RRIFs or annuities by the end of the year they turn 71. It is important to note that if you purchase annuities with registered funds (from an RRSP) the entire payout is taxable exactly the same as RRIF or RRSP withdrawals. With non-registered funds you can purchase a “prescribed annuity” which is subject to tax only on the payout’s interest portion (small percentage).

Many experts say the “sweet spot” for buying annuities is around age 70. One option is to gradually annuitize over three to five years. For example if you plan to annuitize $300,000, you might buy $100,000 of annuities at ages 70, 72 and 74. This timing works great for retirees, since they must convert their RRSPs into either RRIFs or annuities by the end of the year they turn 71. It is important to note that if you purchase annuities with registered funds (from an RRSP) the entire payout is taxable exactly the same as RRIF or RRSP withdrawals. With non-registered funds you can purchase a “prescribed annuity” which is subject to tax only on the payout’s interest portion (small percentage).

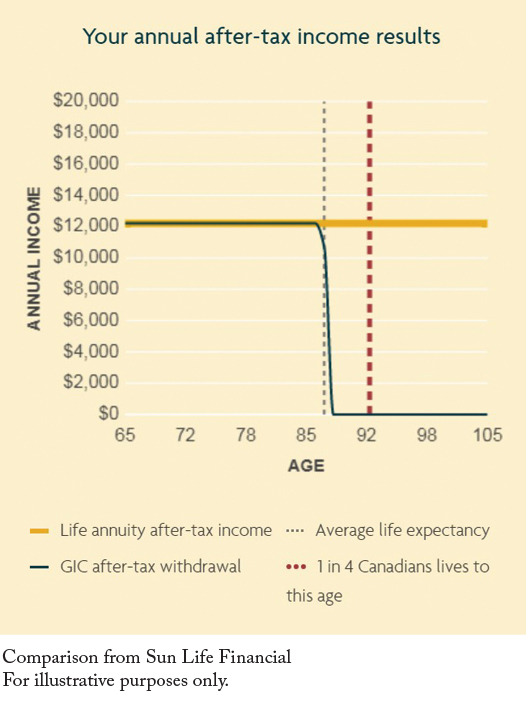

In the graph above I have compared an annuity with a GIC (or Term Deposit). As you can see, the annuity will continue to pay the same amount as long as you live, but the GIC option will run out of money around age 87. In this example we started with $250,000 of RRSP money for a 65 year old male with payments beginning immediately. For the GIC we assumed an average 3% rate of return (today our best Term Deposit rate is 2.35%). The annuity will provide an income for a minimum of 10 years guaranteed. The estimated annual income will be $15,263 before tax and $12,210 after tax.

With the right planning and the right annuity, there will be no need to worry about how long you live, and your retirement income will be guaranteed.

If you are concerned about outliving your retirement savings or have questions about annuities please contact me for a chat. Along with your financial advisor, we will discuss the pros and cons of each option and design the right plan for you. I look forward to hearing from you.

Blessings,

Ryan Van Niejenhuis, BA

Insurance Advisor

Credential Financial Strategies Inc.

Credential Financial Strategies Inc. offers financial planning, life insurance and investments to members of credit unions and their communities. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal advice. Please speak to your Credential Financial Strategies Representative or personal financial representative before making any financial planning decision or implementing any strategy. Your insurance contract will provide details of the coverage available under the plan you choose. Restrictions may apply.

Search

Search

www.google.com

www.google.com